Competitive Intelligence Analysis

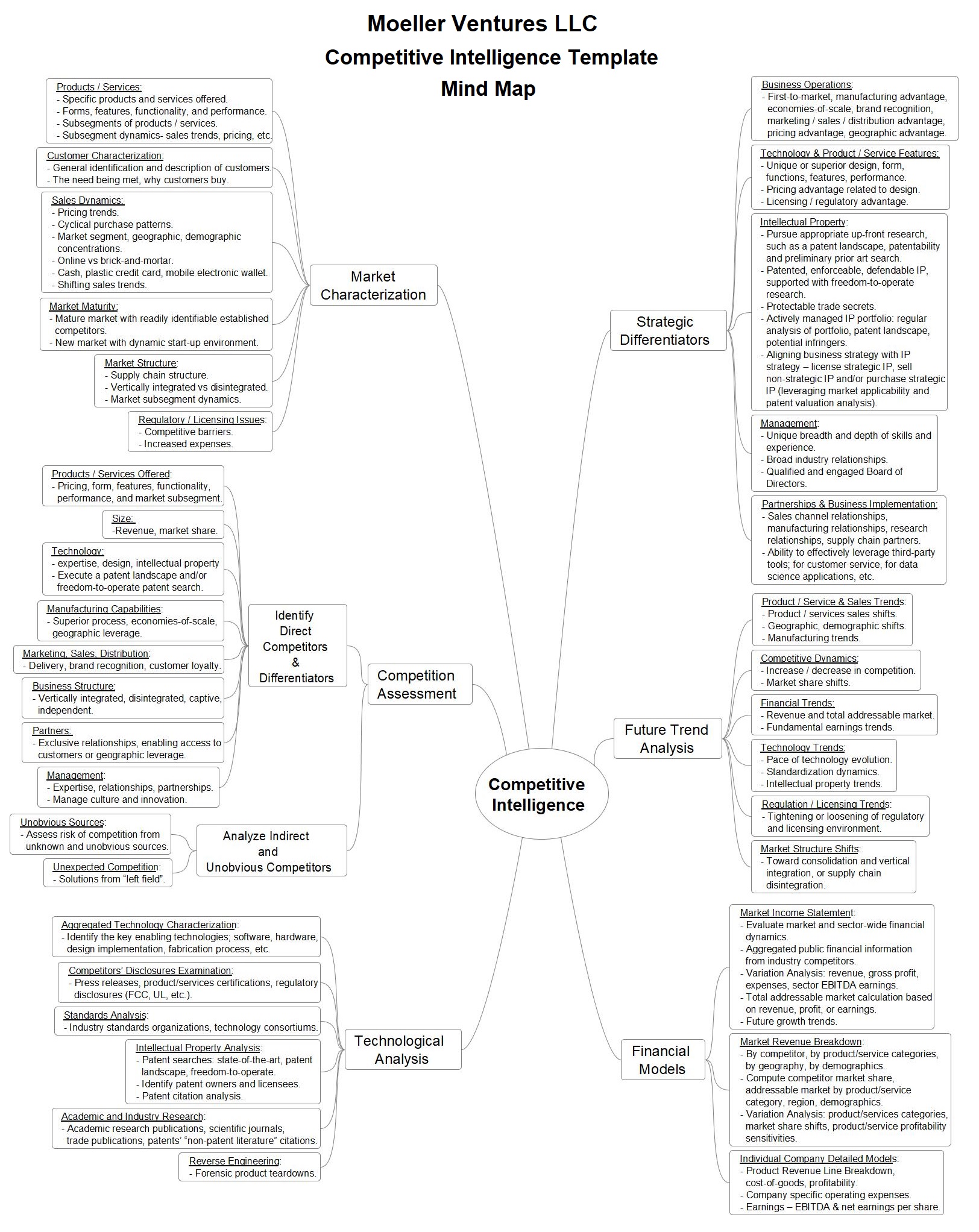

I present a mind map that represents the information structure and analytical approach for executing competitive intelligence (CI) projects. The mind map is designed to be a reference for conceptualizing individual CI projects and for potentially prompting ideas of what can be included in a customized project for the reader’s specific market. I breakdown competitive intelligence into six topic areas as listed below.

- Market Characterization

- Competition Assessment

- Technological Analysis

- Financial Models

- Future Trend Analysis

- Strategic Differentiators

The market characterization summarizes the high-level market dynamics and the overall value proposition of the need being met. The competition assessment catalogues the various competitors and focuses on how each succeeds (or fails) in the market. The technological analysis is a broad examination of the technology and intellectual property that is utilized in solutions. And the financial models section adds profit and loss insight via a market macro model and individual company analysis. Beyond that, that future trends analysis and strategic differentiators section both build on information in the other sections. The future trends section accumulates the various product and service, technology, and finance trends to help develop perspective on future business plans. Finally, the strategic differentiators section focuses on the key aspects of why a business succeeds in the market. Ultimately, I believe this report and the mind map can be utilized to design focused competitive intelligence projects that produce meaningful and actionable results.

Gathering competitive intelligence for your business can be a complex and inexact process. The information sources, analysis subtleties, and breadth of research can vary depending on the markets and products or services being examined. But despite those complexities, I believe there is a general structure to the information and an analytical approach that can be pursued. That is the topic of this report and represents a methodology that has served me well over many years of executing competitive intelligence projects. The intent here is to provide a high-level summary of what constitutes a competitive intelligence profile, as well as an analysis approach to break down the profile into individual pieces that can be pursued as independent projects to build your competitive knowledge base.

I define competitive intelligence as the full spectrum of information that a business uses to compete in its markets. This information can be broken down into six topic areas; market characterization, competition assessment, technological analysis, financial models, and an extrapolation of this information into future trends and strategic differentiators. Ultimately, it’s these strategic differentiators that determine a business’ ability to succeed in the marketplace. My definition of competitive intelligence and the description below are the results of three decades pursuing research projects across markets, technology, and finance, as a consultant and patent agent, investment banking analyst, and engineer (Curriculum Vitae: https://www.moellerventures.com/index.php/jims-curriculum-vitae, Example Projects: https://www.moellerventures.com/index.php/past-projects).

I’ve represented the competitive intelligence profile in the mind map diagram in the following figure. This figure demonstrations the significant level of detail required to execute a full analysis and helps to breakdown the intelligence categories into pieces approximately structured as discrete project topics. Ultimately, I believe this can serve as a pictorial reference to help focus actual research projects for gathering competitive intelligence that result actionable conclusions.

Click on the image below for a larger view.

While there isn’t necessarily an exact analysis sequence in a competitive intelligence profile, there are information dependencies and many of those dependencies build on general market information. So, there is usually some amount of market characterization that must be executed as a start. This information typically consists of high-level material that can be accumulated from a wide variety of sources, such as press releases, market research firms, industry trade associations, corporate financial reports, and government sources.

The market characterization frames and focuses the competitive intelligence analysis and describes the general characteristics of the marketplace landscape. It first defines aspects such as the specific products and services being offered, as well as a characterization of the customers, and the value proposition of the need being met in the market. In addition, it describes the sales dynamics in terms of pricing trends, purchasing cycles, and sales concentrations according to characteristics such as market segments, geography, and demographics. This analysis also describes how commerce transactions occur, such as if it occurs on-line or at a physical store, and if it’s executed in cash, credit card, or via electronic wallet. It’s also good to note shifting sales movements in any of the above characteristics, as this information becomes useful later in the section on the analysis of future trends.

The market characterization concludes with a few overall descriptions of the maturity, structure and regulatory makeup of the market. The maturity of a marketplace can have a significant impact on a market’s structure, operation, and supply chain relationships. For example, if it’s a new market that may lack a defined supply chain, the businesses may be more vertically integrated, and thus tasked with providing a wider breadth of capabilities. Or if it’s an older marketplace, the businesses may be more disintegrated, where each business is more focused and specialized on various market subsegments, and yet more reliant on other businesses in the supply chain. Additionally, if the market exhibits a subsegment structure, those subsegments may have dramatically different value proposition characteristics. For example, one subsegment may provide high value products or services, and have correspondingly high market leverage and profit margins, whereas other subsegments are maybe more commoditized with lower profit margins. Finally, it’s always instructive to analyze the regulatory and licensing environment, which can affect market function by potentially limiting competition and raising expenses.

By default, most businesses have some information about the competitive landscape of the markets in which they compete. But a deeper competition assessment can add insight and perspective into how competitors excel and profit in the marketplace.

In general, the competition assessment is used to identify the existing competitors and highlight each competitor’s differentiating characteristics. This starts with an analysis of the specifics of each competitor’s products and services offering (products/services, price, form, features, functionality, performance) as well as any specific market subsegments that are addressed by those products. In addition, the quantitative and relative size of each competitor can be evaluated in term of revenue and market share, and provide insight into the concentration of the competitive landscape. This can show any leading competitors that may have greater market influence or economies-of-scale leverage.

The technology can be evaluated in terms of each competitor’s level of expertise and design capabilities, and further assessed by digging into any intellectual property. For example, patent searches can be performed by company name to find those patents issued to, or assigned to each competitor. Furthermore, a patent landscape search can be performed that will present a general assessment of the patent environment in the market sector. For more detailed concerns about specific patents, a freedom-to-operate search can be performed to determine potential intersections that may act as commercialization roadblocks.

Business operations and management aspects can be factored into the competition assessment as well. For example, product manufacturing or service delivery costs can be assessed for any advantages that can be leveraged into superior market pricing. The marketing, sales and distribution can be evaluated to uncover competitors that do better at brand recognition and customer loyalty, as well as order fulfillment and product or service delivery execution. The structure of the business can be important, such as if its vertically integrated or more disintegrated in its supply chain structure, and if it’s an independent business or part of a larger organization. This structure analysis can indicate the extent, and any advantages or disadvantages, to which a competitor is more independent of or dependent on industry supply-chain partners. Thus, an analysis of partner relationships is important and can uncover any differentiators associated with partnerships that may be exclusive or allow access to advantageous capabilities. From an operations perspective, the management team can also represent a significant positive or negative differentiator in terms of the general ability to position a business for success. This includes management’s expertise in the market, their industry relationships, and their ability to manage an innovative environment.

Finally, while most businesses tend to focus on threats from existing competitors, it can also be useful to analyze competitive threats from indirect or unobvious sources, such as adjacent marketplaces or similar solutions from a completely different market. My favorite example is the mobile phone and the wrist watch. When the mobile phone was introduced, wrist watch manufacturers like Timex and Seiko probably didn’t view it as competition. But today, if you ask anyone under the age of 30 for the time of day, they’re more likely to look at their mobile phone as opposed to a watch on their wrist.

An aggregated market technological analysis is designed to show a more complete representation of the state of technology in a market sector. This analysis takes a much broader view than the technology analysis performed in the competition assessment, and consists of profiling information from a wide variety of sources, such as competitors’ products and services descriptions, intellectual property searches, industry standards, applicable corporate or academic research, and even reverse engineering initiatives.

In markets where technology is important, competitors will typically attempt to leverage their technology into differentiating advantages and thus advertise and promote that technology and its capabilities, making that information readily accessible. While these references may lack detail, these can provide the high-level topics that are viewed as important in the marketplace.

Industry standards can be another good source of technology information to the extent that standards are utilized in the market sector of interest. Standards initiatives are typically organized by industry participants or technology consortiums to coordinating a product approach or solution that benefits the market as a whole. These standards are broadly published to disseminate the information and driving standard adoption, and can thus be readily accessed as a research source.

Patent and pending patent application searches can also help survey the technology. A state-of-the art or patent landscape search can be executed to represent the patents filed in technology sectors, and also indicate patenting trends and potentially show gaps where patent opportunities exist. Freedom-to-operate patent searches can also be executed to examine the operational latitude of a patent or set of patents relative to other patents (and pending applications) in the same technology sector. These searches can also identify the patent owners and assignees, and thus identify technology competitors.

Corporate and academic research is sometimes published in scientific or trade journals and other on-line channels and can be used as resources. In addition, the citations section of patent filings can be used to identify non-patent literature, that’s been referenced as part of the patent examination process, to potentially uncover additional applicable technology research references.

Finally, reverse engineering or forensic product teardowns can also be used as a source of technology information. There are many third-party organizations that execute these teardowns, sometimes on popular products for article publications, or on a contract / customized basis for confidential research or patent infringement analysis.

Financial models can be used to identify interesting fundamental characteristics about a marketplace and the competitors. It’s common to think of financial statements as a business-specific computation, but depending on the availability of the information, it’s also possible to utilize financial models to uncover interesting macro dynamics as well, such as the total addressable market opportunity, profitability sensitivities, and effects from market share or product and services category shifts.

For example, in many markets it’s possible to aggregate financial information from publicly available financial reports, typically in situations where most of the competitors in a sector are public companies and/or just simply release periodic financial reports. If that’s not the case, then additional research can sometimes produce reasonable estimates of a market model. These models can typically be structured in an income statement format showing gross revenue, products / services expenses, gross profit, operating expenses, and EBITDA earnings (Earnings Before Interest Taxes Depreciation and Amortization, essentially fundamental market earnings) and structured as time-series data over some number of quarters. With this model it’s possible to execute sensitivity analysis and, for example, determine the influence on earnings from variations in gross profit or revenue. Additionally, a time-series summation of gross revenue can produce an estimated total addressable market opportunity, and if the revenue can be reasonably projected into the future, a future market opportunity can be calculated.

Furthermore, and again depending on the availability of the information, it’s useful to breakdown the revenue and profit line items by competitor, by product and service, by market sector, by demographic, etc., and execute variation analysis on these numbers. This can uncover interesting dynamics such as situations where revenue can increase, but because of shifts to lower profit margin sectors or product / services categories, profitability may actually decline. In addition, it’s possible to compute current and future trends associated with competitor’s market share, the product or service segment addressable market size, trends by region or demographic, and total current and future addressable market sector profit.

Finally, financial models can be applied on an individual competitor basis and utilized in a similar fashion as described above, with a breakdown of the revenue line, variation analysis to determine the effects of profit and product or services category shifts, as well as forecasted future trends.

Analyzing future trends builds on much of the information in the previous sections and can further incorporate a fair amount of estimating and scenario brainstorming. Nonetheless, there are important insights that can be garnered that add value to a competitive intelligence knowledge base.

For example, the market characterization and the competition assessment research can indicate products and services trends such as general pricing, customer demand, shifts in product /services categories, geographic sales, demographic sales, and the competitive dynamics exhibited with market share shifts between competitors. If the financial numbers are available, to breakdown the revenue line according to these characteristics, then it’s possible to incorporate the trend observations into the financial models and estimate the numbers into the future. This can be done for either the market macro model or company specific models, to calculate future product and services shifts and future total addressable market opportunities. This in turn can flow through financial models and project future profitability and earnings trends.

The previous technology, regulatory / licensing, and intellectual property analysis can also indicate future trends. For example, the choice of technology, production integration levels, or the realization that patenting trends foretell a future technology solution. All these can be important factors in the decision process behind how future products and services are positioned.

Finally, it’s possible that the macro dynamics from the market characterization and competition assessment indicate structural changes. For example, the competitive dynamics and market share shifts can indicate a trend toward consolidation in the market, or maybe the execution and performance of a particular competitor may indicate a trend toward disintegration and a break-up of that company. Each of these are important observations relative to how businesses are position in a market.

The strategic differentiators factor together much of the previous research and are generally viewed as the most important piece of a competitive intelligence analysis, as these are the principle drivers of success.

There are many operational aspects that can lead to success, but the timing of when a business is initiated and enters a market, i.e. being first-to-market, or one of the first entrants, can greatly improve the odds of success. However, market timing can be a tricky thing. If the timing is too early the business initiative can burn out before it gets customer traction, and if it’s too late, it can fail for being an undistinguished “also-ran” competitor. Early market entrants will also generally capture market share first and be able to establish initial brand recognition and customer loyalty. Beyond that, advantages enabled by manufacturing or service delivery can become important. For example, a product could be cheaper to manufacture or a service easier to deliver, which could lead to a fundamental pricing advantage in the marketplace. If there also happens to be a market share advantage, then economies-of-scale can be utilized for additional pricing leverage. A business can also establish operational strategic differentiators by focusing on superior sales, marketing and distribution. Sometime these are as straightforward as making the purchase process frictionless and easy for customers. Or maybe it’s a superior distribution process that get the products or services to the customer in a more timely fashion. Or superior marketing that, even without a first-mover market advantage, establishes better brand recognition and customer loyalty. Ultimately, techniques establishing strategic differentiators via business operations can be quite varied and specific to the business and market being analyzed.

Strategic differentiators related to the specific products and service, as well as intellectual property, are also mostly built off the previous research sections. For example, the competition assessment or technological analysis may have identified design characteristics that may be significantly more customer friendly or ergonomic than the competition, or may be implemented such that there is a cost advantage, leading to a pricing advantage in the market. In addition, product and service characteristics such as features, functionality and performance may have been identified as significant differentiators. All of these differentiators can potentially be viewed as intellectual property and appropriate protection of that IP can be pursued. Typically, patents are viewed as the common way to protect intellectual property, but depending on the differentiating characteristic, maintaining the IP as a trade secret maybe be a viable option as well. But patenting strategic differentiators for products and services isn’t necessarily easy. Pursuing a patent can be a long and expensive process, and may not even result in an issued patent or a patent with valuable, enforceable claims. So, it’s extremely beneficial to execute the appropriate up-front research. This includes executing a patent landscape search, to determine what patents already exist in the focus technology area, and executing some level of a preliminary prior art search, that encompasses not only issued patents but also examines pending patent applications and non-patent literature (scientific research, industry technical references, etc.), all to provide an initial indication of the patentability of the idea. If patent protection is pursued it is important to focus on the objective value of the patent(s) in terms of the enforceability and defendability of the claims. A freedom-to-operate analysis can often aid in this process.

So, pursuing and even being granted patent protection doesn’t ensure that strategic differentiators will lead to success in the market. This is where the topic of business culture and innovation management become important. Businesses that successfully leverage intellectual property typically have a culture that makes innovation management a core part of their operations. This includes actively managing the intellectual property portfolio as well as the broader landscape of IP in the market where potential infringement can occur. Innovation management also extends into business strategy where it’s important that the future growth strategy align with the IP development strategy. To the extent that these don’t align, it may be beneficial to examine licensing or purchasing other strategic IP and even selling off non-strategic IP.

Finally, any discussion of strategic differentiators wouldn’t be complete without a broader mention of the role of management, and management’s impact on partnerships and business implementation, as these can have a dramatic effect on the success of a business. Clearly the management team must have expertise in the market in which the business competes. But it’s also advantageous to have a team with deep relationships across the industry, which can be strategic in managing connections for sales channels, manufacturing capabilities, supply chain partners, and other research relationships. The management team is also tasked with making sure the business operations are focused on those areas where real value is created and, conversely, with finding alternative or third-party solutions for non-strategic operations. A business will often achieve its best success by focusing the majority of its resources on what it is truly good at and what it strategically needs to be good at, and then find other solutions for everything else. Assessing the role and impact of management as a strategic differentiator can be an elusive challenge and can change as the business grows and matures. But, without a doubt, quality management is universally deemed to be one of the most important drivers of business success.

The discipline of competitive intelligence has been around for many decades, initially materializing out of the exercise of strategically analyzing businesses and markets. It has evolved quite dramatically over time to now include often highly detailed analysis, much of which has been mentioned this report. However, I believe there are more dramatic transformations ahead as the practice of competitive intelligence further intersects with the world of data science. While there has always been a high degree of automation and data analysis in competitive intelligence, the future integration of artificial intelligence, machine learning and big data can potentially drive the discipline to an entirely new level. Stay tuned.